Returning an interest-free loan to the founder on the card is a simple and safe way to repay loan obligations. Find out how to avoid possible mistakes in such a situation from our material.

Can a founder lend to his company?

The company and its founder, if necessary, can act as parties to a loan agreement - a mutual agreement on the transfer of funds or other property to the borrower from the lender into ownership.

Find out more about borrowed funds by following the link.

Borrowing relationships with the founder allow the company to urgently receive money or other items at the lowest cost:

- for carrying out current economic activities;

- expansion of the material base;

- introduction of new technologies;

- for other purposes (for making a deposit for participation in a tender, paying off debts, etc.).

There are no special regulatory restrictions in relation to the company (borrower) and the founder (lender). Therefore, the founder can lend his company:

- money or any other property that has common generic characteristics (model, color, variety, etc.) - clause 1 of Art. 807 Civil Code of the Russian Federation;

- borrowed funds in any amount and for any period;

- with or without interest.

The borrowing company can borrow from the founder:

- regardless of the size of its share in the authorized capital;

- for specific purposes (targeted loan) or without specifying the purpose of the loan;

- subject to the obligation to return the borrowed funds received and to formalize the loan agreement in writing (Article 808 of the Civil Code of the Russian Federation).

You can download a sample loan agreement with the founder using the link.

Loan agreement with the founder: how to protect yourself from mistakes?

The return of money under the loan agreement is one of the final stages of the borrowing relationship. It is preceded by such important procedures as:

- agreeing on the terms of the loan;

- drawing up a loan agreement;

- transfer of borrowed funds from the founder to the company and preparation of a supporting document (transfer and acceptance certificate, receipt, etc.);

- reflection in accounting of operations to obtain borrowed funds.

If mistakes are made in these steps, problems may arise at the loan repayment stage. Therefore, check in advance:

- whether the property transferred under the loan agreement has individual characteristics (for example, a car with a title and identification number cannot be the subject of a loan);

- currency of the monetary obligation - according to Art. 317 of the Civil Code of the Russian Federation, such an obligation must be expressed in rubles (foreign currency may appear in the loan agreement, but only as an equivalent at the rate of the Central Bank of the Russian Federation);

- whether the loan agreement provides for all its essential (subject of the loan and its repayment) and additional (repayment period, interest-free condition, etc.) conditions.

Loan repayment: what to consider first?

Before deciding whether to return the interest-free loan to the founder on the card, you need to check:

- the founder-lender has no debt to contribute a share to the authorized capital - if the founder has not contributed his “authorized” share in a timely manner or has not transferred it to the company in full, the borrowed funds received will be used to pay off such debt, and there will be nothing to return to his card;

- the presence in the loan agreement of a condition allowing the use of a method of returning borrowed money to the founder’s card;

- compare the types of borrowed funds received by the company from the founder and the funds returned by it under the loan agreement.

If you received a batch of building materials under a loan agreement, then there can be no question of any return to the loan card in cash. Borrowing relationships presuppose a single rule: “what you borrow, return it” (Clause 1, Article 807 of the Civil Code of the Russian Federation).

Thus, having ensured against mistakes at the stage of agreeing on the terms of the loan agreement and having made sure that the loan can be repaid in money to the card of the founder-lender, you can proceed directly to the procedure for returning the borrowed funds (see below).

Returning an interest-free loan to the founder: which method to choose?

A company can only have 2 legal “cash pockets”, from which it can transfer to the founder the funds borrowed from him:

- from a current account;

- from the cash register.

To transfer to the founder’s card from a current account you will need:

- a description in the loan agreement (or in an additional agreement to it) of a similar method of debt repayment;

- indicating in it detailed bank details for transferring money to the card.

If a company does not have money in its current account, but it does have it in the cash register, it is important to consider the following:

- you cannot issue money from the cash register to repay a loan from proceeds (clause 4 of the Bank of Russia Instruction on the procedure for conducting cash transactions No. 3210-U dated March 11, 2014, Decision of the Moscow City Court dated December 14, 2012 in case No. 7-2207/2012);

- funds from the cash desk are deposited into the current account, and then a transfer is made to the founder on the card with a note in the purpose of payment “Return of funds under the loan agreement dated __ No. __”).

Do not neglect cash restrictions, otherwise you may suffer financially - according to Art. 15.1 of the Code of Administrative Offenses of the Russian Federation, the fine for this type of cash violations is up to 50,000 rubles.

Which “cash” requirements are dangerous to ignore, is stated in the material “Procedure for conducting cash transactions in 2017”.

Loan repayment procedure: what other conditions should be taken into account and on which accounts should be reflected?

When repaying a debt to the founder under a loan agreement and transferring money to his card, do not forget about the need:

- compliance with the loan repayment schedule stipulated in the loan agreement;

- full repayment of the borrowed debt no later than one month from the date specified in the agreement (if a payment schedule is not provided).

When you cannot do without schedules in your current business activities, learn from the materials posted on our website:

- “How to correctly draw up a schedule for the implementation of professional standards?” ;

- “What does this mean - a rotational work schedule?” ;

- “Working time schedule for 2017 - download the form”.

In accounting, reflect the repayment of the loan to the founder’s card by writing:

Dt 66 (67) Kt 51 - repayment of the loan to the founder’s card under the loan agreement.

Apply:

- account 66 “Settlements for short-term loans and borrowings” - if you borrowed funds from the founder for a period of less than 12 months;

- account 67 “Settlements for long-term loans and borrowings” - if the loan agreement provides for a longer borrowing period (over a year).

The bank statement will confirm:

- the fact of repayment of debt to the founder;

- volume and details of transfers.

If you are repaying the loan in parts, apply all of the above recommendations for each part of the debt being repaid.

What to do if you can’t return the loan to the founder’s card?

Repayment of borrowed funds is a mandatory condition of the loan agreement. However, it may be impossible to return the debt to the founder on the card for a number of reasons, for example:

- there are no funds in the current account;

- The bank account is blocked by the tax authorities;

- in other cases (the bank’s license was revoked, etc.).

If financial difficulties are temporary and sooner or later the company will have the opportunity to transfer the debt under the loan agreement to the founder’s card:

- agree with the lender on the extension of the loan repayment period, review the payment schedule;

- formalize the revision of the terms in an additional agreement to the loan agreement, attach an adjusted payment schedule to it;

- check whether, due to the extension of terms, the loan has become a long-term loan - detailed analytics in this matter allows you to correctly fill out the explanations for the accounting statements and provide its users with complete and reliable information about the company’s borrowed obligations.

This publication will tell you in which line to reflect borrowed capital.

If the company’s financial situation does not improve in the near future and there is no possibility of repaying the debt to the founder under the loan agreement, it is necessary to consider other ways to resolve the issue with the hanging debt. Find out about one of these methods in the next section.

Resolving the issue with a “stuck” loan

Any loan burdens the balance sheet liability - it increases the total amount of the company's debts and affects individual financial ratios, as well as the overall financial position.

This situation can be easily resolved by the lender himself - the founder of the company. He has the power to relieve his company of the debt burden by forgiving the debt under the loan agreement.

If the founder decides to forgive his company’s debt, he must:

- take into account the fulfillment of the requirements of Art. 415 of the Civil Code of the Russian Federation - the founder can forgive the company’s debt if this does not violate the rights of other persons in relation to the creditor’s property;

- formalize debt forgiveness by agreement or other document;

- reflect the forgiven debt in accounting:

- in accounting by including the forgiven debt in other income (Dt 66 (67) Kt 91);

- in tax accounting, take into account the amount of debt in non-operating income if the share of the founder who has forgiven his debt to the company does not reach 50% (subclause 11, clause 1, article 251 of the Tax Code of the Russian Federation); if his share is 50% or more, the income is not reflected in tax records.

The founder can forgive both part of the debt under the loan agreement and the entire amount of the interest-free loan.

Results

Borrowed funds can be returned to the founder’s card only by transfer from the company’s current account and provided that the loan was provided in money. This method of loan repayment must be specified in the contract or additional agreement to it.

Quite often, when enterprises lack funds, they use the money of the founders, which is formalized in the form of a loan received. In this article we will look at how to reflect a loan from the founder in 1C Accounting 8th edition. 3.0, its receipt, calculation of interest and personal income tax, as well as loan repayment.

Let's look at an example:

The organization Plyushka LLC (borrower) received a short-term loan from the founder M.M. Maslov. (lender) for a period of 3 months. The founder is not an employee of the organization. The founder is a resident of the Russian Federation. The purpose of the loan is to replenish working capital. In accordance with the terms of the agreement, the loan amount is RUB 200,000.00. Loan Agreement No. 234 dated 06/01/2018

Interest on the used loan is calculated from the date of transfer of funds to the borrower's current account for the balance of the loan debt and is paid on the last calendar day of the month for the actual number of days of use of the borrowed funds. The interest rate is 10% per annum and is not subject to change during the entire term of the agreement. Upon expiration of the contract, the loan is returned to the founder.

The borrowing organization, acting as a tax agent, calculates and withholds the amount of personal income tax from the income of an individual.

On June 1, 2018, the loan was transferred to the organization’s current account. In 1C Accounting 8, the document “Receipt to the current account” was drawn up with the type of operation “Receiving a loan from a counterparty”. Located in the “Bank and cash desk” section

According to the document, a posting was generated: Dt 51 Kt 66.03 in the amount of 200,000 rubles.

On June 30, 2018, interest was accrued for the first month: 200,000 * 10% = 20,000 rubles / 365 * 30 = 1,643.84 rubles.

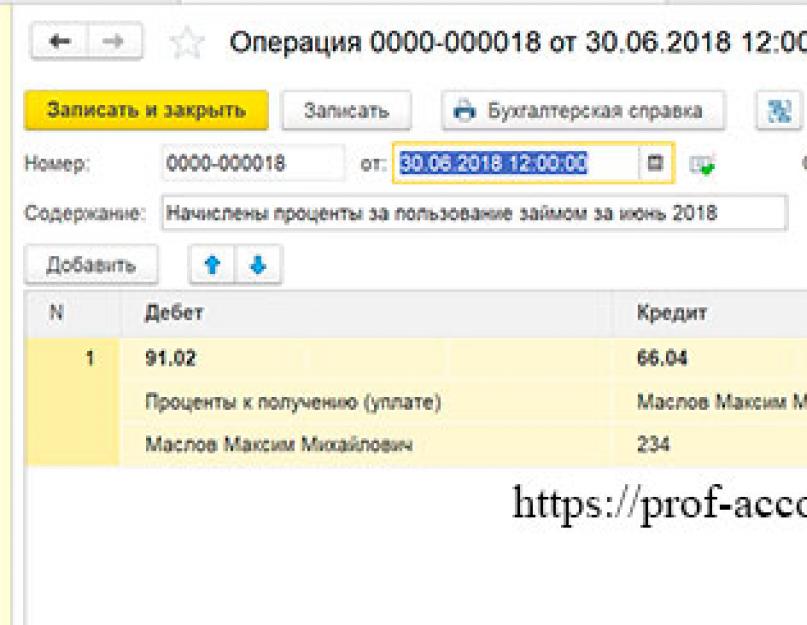

Interest is calculated using the “Operations entered manually”, section “Operations”.

According to the document, a posting was generated: Dt 91.02 Kt 66.04 in the amount of RUB 1,643.84.

And in order to calculate personal income tax on interest, it is necessary to transfer the amount of debt from account 66.04 to account 76.09 “Other settlements with various debtors and creditors.” To do this, we will use the document “Debt Adjustment” with the transaction type “Other Adjustments”. Located in the “Purchases” or “Sales” sections.

The “Accounts Receivable” tab will be filled in here, where the account 76.09 is indicated

And the “Accounts Payable” tab, where the account 66.04 is indicated.

According to the document, a posting is generated: Dt 66.04 Kt 76.09 in the amount of RUB 1,643.84.

Now let's calculate personal income tax. We also accrue it using an operation entered manually.

According to the document, a posting is generated Dt 76.09 Kt 68.01 in the amount of 214 rubles.

In order for the amount of withheld personal income tax to be reflected in the reporting, it is necessary to create a document “Personal Income Tax Accounting Operation”, located in the “Salaries and Personnel” section.

First, fill out the “Income” tab. Click the “Add” button and indicate the date of receipt of income, income code – 1011 “Interest, including discount received on a debt obligation of any type (except for income with codes 1110, 2800 and 3020)” and the amount of income. In our example, 1,643, 84 rubles.

The second tab “Calculated at 13% (30%) excluding dividends.” Here, using the “Add” button, indicate the date of receipt of income and the amount of personal income tax of 214 rubles.

Then we go to the “Withheld at all rates” tab, click on the “Add” button and indicate the date of receipt of income, the tax rate and the rate of 13%, the amount of tax withheld is 214 rubles. And also the transfer deadline - No later than the day following the payment of income (for other income), the enterprise is obliged to pay personal income tax on rent no later than the day following the day the income is paid to the taxpayer (clause 6 of Article 226 of the Tax Code of the Russian Federation) and income code 1011 " Interest, including discount received on a debt obligation of any type (except for income with codes 1110, 2800 and 3020). In the column “Amount of income paid, indicate the amount of 1,643.84 rubles.

Now we will transfer the interest amount to the lender. To do this, we will issue the documents “Payment order” and “Write-off from the current account”. Type of operation “Repayment of loan to counterparty”. And in the write-off document we will indicate the type of payment “Payment of interest”.

The posting will be generated: Dt 76.09 Kt 51 in the amount of 1,429.84 rubles.

We will transfer personal income tax to the budget using the same documents, only the type of operation will be “Payment of taxes and contributions.”

We will similarly reflect the accrual and payment of interest for July and August.

On August 31, 2018, we will reflect the repayment of the loan to the founder with the documents “Payment order” and “Write-off from the current account.” Type of operation “Repayment of loan to counterparty”. In the write-off document we indicate the type of payment “Debt repayment”.

In this way, you can reflect the loan from the founder in 1C Accounting 8.

If you need individual training, consultations and other services for working with 1C, take a look at the section

More details about a loan from the founder in 1C Accounting 8th edition. 3.0 watch in the video:

Any enterprise, especially one that has been operating recently, may encounter financial difficulties. What to do in this case, take out a loan? But this is not always possible, so many founders lend to their own organization “until better times.” Let's look at how to reflect this operation in 1C Accounting 8.

The easiest option for accounting and the most profitable option for the company is when the loan is issued without interest. In this case, when a loan is received into the company’s account, a “Receipt to Current Account” document is drawn up, located on the “Bank” tab on the desktop or called from the top “Bank” menu. Type of operation “Settlements on loans and borrowings”. According to the document, posting Dt 51 Kt 66.03 is generated

When repaying the loan amount, the “Payment Order” document is filled out in full or in part, and on the basis of it, a “Write-off from the current account” is generated with the type of operation “Settlements on loans and borrowings”. Wiring Dt 66.03 Kt 51 is being formed

The second case is when the loan is issued with interest. The loan application document will be similar to the previous situation. Next, you need to calculate interest using a manual operation. Wiring Dt 91.02 Kt 66.04.

Since the loan is issued by an individual, the amount of interest must be transferred to account 76, subaccount 09 using the “Debt Adjustment” document. Type of operation “Carrying out netting”. The first tab “Mutual settlements” is filled in the document. The first line here indicates accounts payable and the second line receivable. According to the document, the posting Dt 66.06 Kt 76.09 is generated

The transfer of interest to the lender is reflected in 1C Accounting 8 using the documents “Payment order” and “Write-off from current account”, which can be made on the basis of a payment order. The transaction generates transaction Dt 76.09 Kt 51.

Since receiving interest on a loan is income for the founder - an individual, do not forget to withhold and transfer personal income tax at a rate of 13%. Withholding personal income tax is reflected in 1C Accounting 8 by manually entered entries: Dt 76.09 Kt 68.01

However, simultaneously with this posting, you need to fill out the document Entry of income, personal income tax and taxes (contributions) from the payroll. You can find it in the top Salary menu, the last item is “Data for accounting salaries in an external program.”

The document is needed in order for the tax amount to be included in the 2-NDFL card, since for transactions entered manually, the personal income tax does not appear on the card.

There are three bookmarks to fill out in the document. The first tab indicates the amount of income.

On the second the amount of personal income tax and on the third the personal income tax withheld.

Loan accounting in 1C is partially automated, so you have to perform some operations manually or use additional processing. First of all, this concerns the calculation of interest and material benefits that may arise when a loan is issued to an employee of an organization without interest, or there is interest, but it is less than 2/3 of the refinancing rate.

In the latest 1C releases, accounting accounts for both loans and interest on them are entered automatically, so for the correct formation of transactions, the accountant only needs to fill out the document details correctly.

Let us consider in detail the execution of operations for issuing and repaying a loan. Let’s assume that an employee of the organization PromTech LLC, S.V. Larionova. A short-term loan was issued in January 2016.

Our example conditions:

- The loan amount is 120 thousand rubles

- Loan term – 12 months

- Loan percentage – 6%

- Refinancing rate – 11%

We will calculate the amounts of payments, interest and personal income tax using special processing (Fig. 1). If there is no such processing, you will have to count manually.

Debt repayment begins in the month following the month the loan was issued, in our case - from February 2016.

Formulas by which interest and material benefits are calculated:

- Amount of interest = Amount of Debt * Interest * Number of days in a month / Number of days in a year

- Amount of financial benefits = Amount of Debt (2/3 refinancing rate - interest) *Number of days in a month/Number of days in a year;

All calculations have been completed. Now let's see what documents need to be generated in 1C to reflect the loan.

Issuing a loan through a current account

Figure 2 shows a payment order according to which the loan amount is transferred to the employee. The main thing you should pay attention to when filling out this document is the type of operation. In this case, it is “Issuing a loan to an employee.” The subaccounts in the transactions depend on the type of transaction.

Based on the payment order, it is issued (Fig. 3).

After completing this document, we will receive entries in correspondence with account 73.01 “Settlements for loans provided” (Fig. 4) in accordance with the previously selected operation.

Get 267 video lessons on 1C for free:

Deduction of interest on a 1C loan from an employee’s salary

Now let’s figure out how to reflect deductions from an employee’s salary. For this purpose we use three documents:

- Payroll

- Manual entry

- Personal income tax accounting operation

The amounts of principal and interest on it are recorded in the document “” (Fig. 5).

Please note that in order to fill in the payment amounts, you must first add two types of deductions to the general list of deductions.

Unfortunately, these amounts will not be reflected in the postings, since the “Payroll” document does not move the accounting register. You will have to create a document “ ” (Fig. 6).

To reflect personal income tax, select the document “Personal income tax accounting transactions” (Fig. 7)

We fill out two tabs in it: “Income” (Fig. 8) and “Withheld on all bets” (Fig. 9).

The same income code is selected on both tabs - 2610.

Reflection of employee personal income tax

And one more manual operation, the most difficult, with filling out registers (Fig. 10). It is needed to reflect personal income tax on material benefits in accounting.

We fill out the operation itself (Dt 70 - Kt 68.01) and select two registers:

- Mutual settlements with employees

- Salary payable

The registers are filled in for the same amount (personal income tax amount calculated earlier) with a minus sign. Type of movement – “Coming” (Fig. 11).

The founder can provide or receive a loan to his company. The agreement stipulates all the conditions for receiving/issuing borrowed funds. Including whether interest will be charged for their use. In this article we will look at the legal aspects and transactions for accounting for loans between the founder and the organization.

The founder issues an interest-bearing loan:

- Debit 66 (67) Credit 50 ().

Percentages are expressed by writing:

- Debit 91.2 Credit 66 (67).

Interest on accounts 66 is accounted for in a separate subaccount.

As a loan, the founder can pay the debt of his organization:

- Debit 60 Credit 66.

This type of operation is not prohibited by civil law. Difficulties and disputes arise when accounting for VAT.

When providing an interest-free loan by the founder, the transactions are the same, only the agreement must stipulate that interest is not charged for the use of money or property.

When the founder decides to “forgive” the organization’s debt, his share in the company must be taken into account. If the founder's share is more than 50%, then no taxable profit arises.

An organization can pay off its debt not only with money, but also with its products: First, revenue from the sale of products is reflected against the debt to the founder:

- Debit 76 Credit 91.

VAT must be charged on sales:

- Debit 90.3 Credit.

Debt offset:

- Debit 66 Credit 76.

Example of transactions for issuing an interest-free loan from the founder

The sole founder issued an interest-free loan to the company in the amount of 200,000 rubles. for 10 months. The interest rate on the loan is 2% per annum.

Postings:

| Account Dt | Kt account | Wiring description | Posting amount | A document base |

| Received a loan from the founder | 200 000 | Bank statement | ||

| 91.1 | Reflection of interest accrual for using a loan | 3333 | Accounting information | |

| Loan debt transferred to founder | 200 000 | Payment order ref. | ||

| Interest transferred | 3333 | Payment order ref. |

Issuing a loan to the founder

The issuance of a loan to the founder, if it is interest-free, is reflected by the posting:

- Debit 76 (73) Credit 50 ().

At the same time, the founder receives a benefit from interest savings (material), with which it is necessary to pay personal income tax. Account 73 is used if the founder is an employee of the company.

If the loan is with interest, then the issuance of money is formalized:

- Debit 58 (73) Credit 50 ().

When issuing a loan in the form of property:

- Debit 58 (73) Credit 01, 41, ...

Interest on the loan for the founder is reflected by the entry:

- Debit 76 (58.73) Credit 91.1.

Posting example

The founder, who is the director of the company, was given a loan in the amount of 50,000 rubles. for 180 calendar days at 3% per annum.

Postings:

| Account Dt | Kt account | Wiring description | Posting amount | A document base |

| 73 | 50 | A loan was issued to the founder | 50 000 | Account cash warrant |

| 73 | 91.1 | Interest accrued for using the loan | 750 | Accounting information |

| 50 | 73 | The loan was returned by the founder | 50 000 | Receipt cash order |

| 50 | 73 | The founder paid interest on the loan | 750 | Receipt cash order |